Preview: “The market for bitcoin transaction inclusion and the temporal root of scarcity”

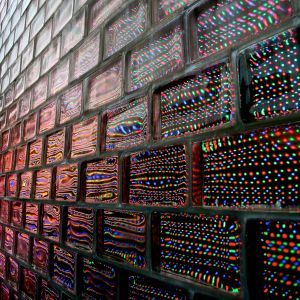

/ What do you see in those blocks? Source: Wikimedia Commons: “Crown Fountain” by Tony Webster.I have been considering the Bitcoin block size debate for quite a few months (next to some other large projects), reading, learning, and applying principles. It is such an important and contentious issue that I have taken extra time before commenting at all to research and keep following the wide range of factors, opinions, and related issues.

What do you see in those blocks? Source: Wikimedia Commons: “Crown Fountain” by Tony Webster.I have been considering the Bitcoin block size debate for quite a few months (next to some other large projects), reading, learning, and applying principles. It is such an important and contentious issue that I have taken extra time before commenting at all to research and keep following the wide range of factors, opinions, and related issues.

In seeking to apply economic theory in new ways, and when addressing Bitcoin in particular with it, I try to take even more care than usual to first acquire a sufficient technical understanding so that I can usefully apply such theory to the case. The block size issue has set that bar still higher than it had been with other Bitcoin topics I have addressed.

I am convinced the roots of much of the contention are based primarily in economic-theory differences and only secondarily a technical or even social ones. Additional issues of governance and decision-making likewise come to the fore mainly when people are severely conflicted on what the right thing to do is and the issues then descend into “political” contests of influence and persuasion. There are also economic ways to understand the kinds of circumstances under which issues tend to become viewed as “political” in nature rather than not.

In short, if it were clear what ought to be done, that could be implemented with some work. Yet not only has widespread consensus on the right thing to do been slow to arrive, but the disagreements appear rooted more in differing opinions on economics, a specialized field entirely distinct from engineering, programming, and network design. Worse, too much of what passes for “economics” in the official mainstream today has been built upon a foundation of long-refuted non-sense. So using that is unlikely to help matters along either.

A 30-page written treatment is in the editing and review phase. For now—in response to numerous behind-the-scenes requests for comment—here is a summary preview of some of the essentials of my take on this as of now. The forthcoming paper contains citations, support, and step-by-step context building and also covers many more related topics than this summary can touch on.

Summary of some findings

The block size limit has for the most part not ever been, and should not now be, used to determine the actual size of average blocks under normal network operating conditions. Real average block size ought to emerge from factors of supply and demand for what I will term “transaction-inclusion services.”

Beginning to use the protocol block size limit to restrict the provision of transaction-inclusion services would be a radical change to Bitcoin. The burden of proof is therefore on persons advocating using the protocol limit in this novel way. This protocol block size limit was introduced in 2010 as an anti-spam measure. It was to be an expedient to be removed or raised at a later stage as normal (non-attack) transaction volumes climbed. It was not envisioned as having anything to do with manipulating transaction fees and transaction-inclusion decisions on a normal operating basis. The idea of using the limit in this new way—not the idea of raising it now by some degree to keep it from beginning to interfere with normal operations—is what constitutes an attempt to change something important about the Bitcoin protocol. And there rests the burden of proof.

If that burden is not met, the limit ought to be (have already been) raised—by some means and by some amount. Those latter details do veer more legitimately into technical-debate territory (2, 8, or 20MB? new fixed limit or adaptive algorithm? Phased in how and when? etc.), but all such discussions would be greatly facilitated by a shared context on the goal and purpose of any such limit having been placed into the code. A case for establishing some completely new reason to retain this same limit—other than as an anti-spam measure—would have to be made by its advocates if they were to overcome the default or “when in doubt” case. The context shows that this when-in-doubt default case is actually raising the limit, not keeping it unchanged.

Casual and/or rhetorical conflation of the block size limit with the actual average size of real blocks is rampant. This terminological laziness begs the key questions of: whether any natural operational economic constraints on block sizes exist (or could become even more relevant in the future), what those natural constraining factors might be, and what degree of influence they might have on practical mining business decisions. In strict terms, nothing can be done without some non-zero cost. For example, including a transaction in a candidate block carries some non-zero-cost and larger blocks propagate more slowly than smaller ones, other things being equal.

How can the real influences of such countervailing factors be discovered within a dynamic complex process? Markets and open competition excel at just this type of unending trial-and-error tinkering problem. However, setting a blanket restriction at an arbitrary numerical level on the output of transaction-inclusion services across the entire network distorts such processes, preventing accurate discovery and inviting both general economic waste and hidden zero-sum transfers.

Transaction-fee levels are not in any general need of being artificially pushed upward. A 130-year transition phase was planned into Bitcoin during which the full transition from block reward revenue to transaction-fee revenue was to take place. The point at which transaction-fee revenue overtakes block reward revenue should not have been expected to arrive any time soon—such as within only the first 5–10% of time that had been planned for a 100% transition. Transaction-fee revenue might naturally come to exceed block reward revenue in say, 20, or 30, or 50 years, or whatever it ends up being. Yet even that is still only a 50% milestone in the full transition process. Envisioning the long-term future of mining revenue should also factor in the clear reasons for anticipating steady secular growth in real bitcoin purchasing power.

Most fundamentally, scarcity is being treated in this debate largely using an intuitive image of “space in blocks.” However, scarcity follows from the nature of action as inevitably occurring within the passage of time. Actors would like to accomplish their objectives sooner rather than later, other things being equal. Time is the ultimate root and template for scarcity, because goods are only definable in relation to action and any action taken precludes some possible alternative action (“cost”). Scarcity of transaction-inclusion should therefore be understood in terms of relative time to confirmation—which is already today statistically influenced by fee levels.

Finally, discussions of whether bitcoin should or should not be used for “buying coffee” sound embarrassingly like Politburo debates. Market discovery through real supply, demand, and pricing over time allow socially best-possible levels of [average fee multiplied by transaction volume relative to real bitcoin purchasing power] at any given point in (in-motion) time, to be discovered dynamically. The same goes, at the same time, for the relative pros and cons for users of the entire possible existing and future spectrum of off-chain transaction options relative to on-chain ones. The protocol block size limit was added as a temporary anti-spam measure, not a technocratic market-manipulation measure. The balance of evidence still seems to indicate that it should remain restricted to its former role.