We could change where the display shows the decimal point. Same amount of money, just different convention for where the [commas and periods] go…moving the decimal place 3 places would mean if you had 1.00000 before, now it shows it as 1,000.00.

—“Satoshi Nakamoto,” February 10, 2010

In the Kingdom of Geekdom, my €2.60 espresso this morning might have cost 0.0283 BTC (at the 90-day weighted moving average of €92/BTC), perhaps pronounced “point zero two eight three bitcoins.”

Such a string of sounds could only happily emerge from the mouths of card-carrying Geekdom denizens channeling Mr. Spock himself, but it would be most unlikely to pass the lips, or be long tolerated by the ears, of the average Katie, Hans, Taiwo, or Eijiro on the streets of this planet.

And thus a resurgence of interest in changing the standard Bitcoin denomination from a bitcoin (1 BTC) to a millibitcoin (0.001 BTC) has taken shape on the Bitcoin Forum with an informal survey. The top responses to “Should we start using mBTC as the standard denomination?” are 53% for “Yes,” and 20% for “After the price is at $1,000, dollar parity for the mBTC.”

Maybe, but what do we say at checkout?

Maybe, but what do we say at checkout?

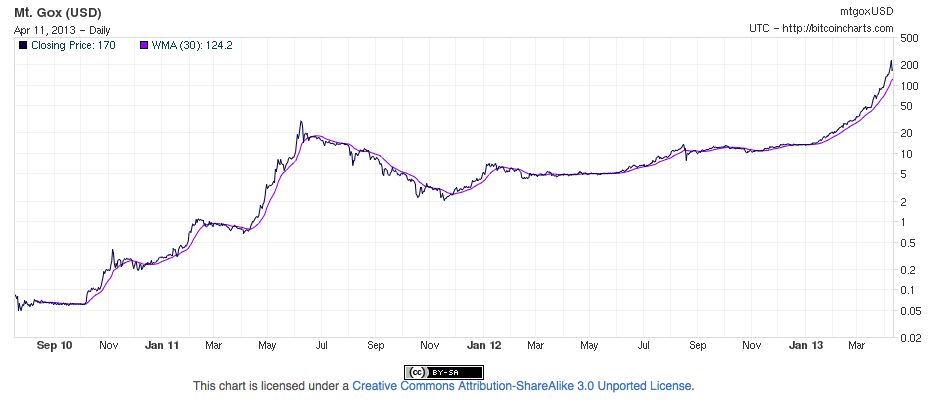

Designed for convenience at much lower value levels, the initial standard “bitcoin” unit, which equals 100 million satoshis, the more fundamental unit within the Bitcoin system, has grown to become far too valuable for most people’s ordinary way of thinking and speaking about prices. A bitcoin has traded over the past several weeks mainly in the $110–$130 range with the 90-day weighted moving average now just shy of $120. Unlike bitcoin exchange values from earlier years—a few cents and later a few dollars—most ordinary items now have to be bit-priced entirely within the decimal point range, although the luxury houses and cars at Bitpremier could just stay priced in bitcoins. A hypothetical rise to $1,000/BTC would greatly amplify this situation.

A redenomination would only impact the way price numbers are displayed and discussed and would make no fundamental changes to values held. A person with 1 bitcoin could just as well be said instead to have 100 centibitcoins or 1,000 millibitcoins.

In contrast, when political money managers talk of devaluation, redenomination, and most recently “easing,” such machinations actually do signal an active manipulation of purchasing power (always to its detriment). This current discussion simply seeks consensus on practical and linguistic conveniences by, for, and among the wholly self-selected community of participating Bitcoin developers, service providers, merchants, consumers, traders, and even observers.

Yet the difficulties of finding spoken language for naming this new unit, language capable of seeing wide global adoption in everyday use, have proven a lingering challenge. To address this topic, I will draw on conventional pricing usages in several different countries and languages in search of common patterns to use as criteria. I will then apply these criteria to existing proposals for a spoken-language name for the too technical “millibitcoins,” and then offer two suggestions, the second of which I have not yet seen proposed elsewhere.

Before moving on, let us be sure to put this whole “problem” in perspective. This is a “sound-currency problem,” in the sense of the “first-world problems” meme. A rising currency and falling prices of goods and services denominated in it are the kinds of “problems” most people ought to be happy to face. The long, sad history of declining political currency values has systematically punished savers and planners and rewarded debtors and those with less effective foresight, leading to shortening time horizons and eroding senses of personal responsibility.

Falling currency values leave families struggling to meet ever-rising prices for goods and services. By several estimates, the United States dollar, for example, has lost some 97%–98% of its value since its “management” was assigned to the Federal Reserve System in 1913 (I refer those who fear falling prices, the deflation-phobic, to my 29 March 2013, A short Bitcoin commentary on “Deflation and Liberty” and the works linked from it).

Speaking of prices

Since the Bitcoin network spans this entire planet, such linguistic research ought to begin by at least attempting to reference practices in several countries and major languages. I will select examples below from the US, Germany, and Japan, based simply on my own degree of direct familiarity with each (please add other instructive usage examples in the comments). The three numerical examples below are of roughly similar purchasing power in each zone, probably enough to buy another espresso.

The first thing I notice is that it is common to use two decimal places, “cents” after a main unit. Second, in shopping language, the unit names are often omitted altogether. Thus, in the US, a spoken “two-sixty” means two dollars and sixty cents ($2.60). In Germany, “zweisechzig” likewise means two euros and sixty cents (€2.60), or more formally “zwei euro sechzig” (but still most often omitting “zent”). Omitting the unit is facilitated in both cases in the same way: two individual numbers are spoken in sequence, the first specifying the whole unit; the second, hundredths of it.

In Japanese, ¥260 is “nihyaku rokujuu-en”. Here, there is no decimal point, but in effect “hyakuen” (¥100) takes the place of the base unit in the dollar and euro examples. The “yen” (actually pronounced “en”) is not omitted in speech, but it only takes a quick syllable to say it and units are not optional in general. The “hyaku,” also lightning fast to say in Japanese, already works to create a division in ¥260 between the two hundreds and the sixty. This makes it less functionally different from the English and German examples than it might at first appear.

Generally speaking, when the names of currency units are not contextually omitted in speech altogether, they can almost always be pronounced in just two syllables: dollars, euros, pesos, kronas, rubles, rupees…bitcoins. In contrast, “millibitcoin” or “mBTC” (pronouncing each letter) each take up a hefty four syllables and are as such unlikely to survive in non-technical spoken usage.

The bit is dead; long live the bit?

So, what might that unit be called in ordinary speech? Some commentators have identified a problem with “coin.” It is by nature indivisible. On the other hand, “the coin of the realm” does give a more uncountable sense of a money in use in a particular place.

Either way, this provides an easy opportunity to cut out a syllable, and with “coin” duly exiled, proposals for spoken options for millibitcoin have included “millibits,” “embits,” “mills,” “mill,” “millies,” and “bits.” Those thinking way ahead have already termed a microbitcoin (0.000001) a “Mike,” presumably the thin, but loving partner of the much heftier Millie.

“Millibits” came out ahead in an informal naming poll for millibitcoin way back on May 14, 2011. Unfortunately, at three syllables, it is still a mouthful for everyday speech, exceeding the conventional two syllable mainstream for currency unit names.

You want change? Anybody got some tools?

You want change? Anybody got some tools?

“Bits,” at just one syllable, already have a long and storied history in coinage. For centuries, the Spanish silver dollar was a preferred unit of global trade due to its relative freedom from debasement of silver content and its wide international adoption. The peso de a ocho coin was worth eight reales and became known as “pieces of eight” in English, giving pirate parrots something to prattle on about. It has also been said that certain coins were physically cut into eight pieces or “bits” as a way to improvise around small-change shortages using the resulting sharp metallic pie pieces. I am not sure of the ratio of fiction to fact on that one.

The resulting related use of “two bits” to mean a quarter dollar has only recently been fading out of informal use in the US after a long run. Unfortunately, fiat inflation eventually left a quarter dollar unable to buy much of anything and the meaning of “two-bit” declined with it, coming to characterize something of poor quality. A “two-bit coffee” might thus sound rather dilute to modern ears.

Could “bit” be brought back in a decimal-based, high-tech reincarnation? A millibitcoin (0.001 BTC) is now trading at about US $0.13. Twenty of these might buy that espresso at $2.60 and “twenty millibitcoins” (20 mBTC; 0.020 BTC) might be shortened in speech to “twenty bits.”

The centibit challenge and foodie what-ifs

If such bits stood for centibitcoins (0.01 BTC) instead of millibitcoins (0.001 BTC), that espresso might cost about “two bits” after all (assuming $130/BTC). With centibitcoins, a family sushi dinner that might add up to $65.95 would come to “fifty (bits) seventy-three,” or the waiter could say, “in Bitcoin, that’s fifty seventy-three.” That’s 50.73 centibitcoins versus 507.3 millibitcoins and 0.5073 bitcoins.

A centibitcoin redenomination could thus bring things into a familiar range for dollar and euro users right away. At around $130/BTC, a centibitcoin would trade for $1.30, €1.00, and ¥100. That seems intuitively perfect, but only under approximately current rates.

Bitcoin exchange values could stay level or fall. Expecting a long, level trend or modest decline would speak in favor of centibitcoins as the standard unit. If Bitcoin does continue to climb impressively, though, how long before its dollar exchange value adds another digit?

Let us say that the bulls have it and the exchange value of a bitcoin moves to $500 and then $1,000 over the next several years. How would these two alternative redenominations then play out with some everyday examples?

At $500 per bitcoin, a $2.60 espresso would cost 0.0052 bitcoins, 0.52 centibitcoins, and 5.20 millibitcoins. Millibitcoins would win according to the balance of the above criteria (“in Bitcoin, that’ll be five twenty”). The big sushi dinner would be 0.1319 bitcoins, 13.19 centibitcoins, and 131.90 millibitcoins. In this case, either one might look okay.

At $1,000 per bitcoin, the espresso would cost 0.0026 bitcoins, 0.26 centibitcoins, and 2.60 millibitcoins. Millie would win. The sushi would then come to 0.06595 bitcoins, 6.595 centibitcoins, and 65.95 millibitcoins, and millie would win again.

While a centibitcoin transition would make sense for now, an assumption of further exchange value growth would point in favor of the proposed millibitcoin unit. Either way, a redenomination could well be positive. A key challenge for Bitcoin entrepreneurs is helping to broaden adoption into more frequent everyday payments and purchases. Making Bitcoin units easier for contemporary people to talk about in everyday language and think about closer to everyday price numbers could well be helpful.

So how about just putting “m” and “B” together?

“Embies” (mB) is another option I have proposed based on pronouncing “m” and “b”. The B can also be written with the proposed Bitcoin currency symbol when it makes its way into standard character sets. Embie matches the conventional two-syllable criteria. It strikes me as easy to pronounce on a multilingual basis. It also seems friendly and familiar; it could be a pet’s name. I find it easier to say than the two-syllable “embits” candidate. Not all sets of two syllables are equally easy to pronounce.

Still, some people seem to hate it, while others like it. It may be that the name for BTC 0.001 that will prevail in the end has not yet been coined.

For additional articles on this topic, visit my Bitcoin Theory page on this site.